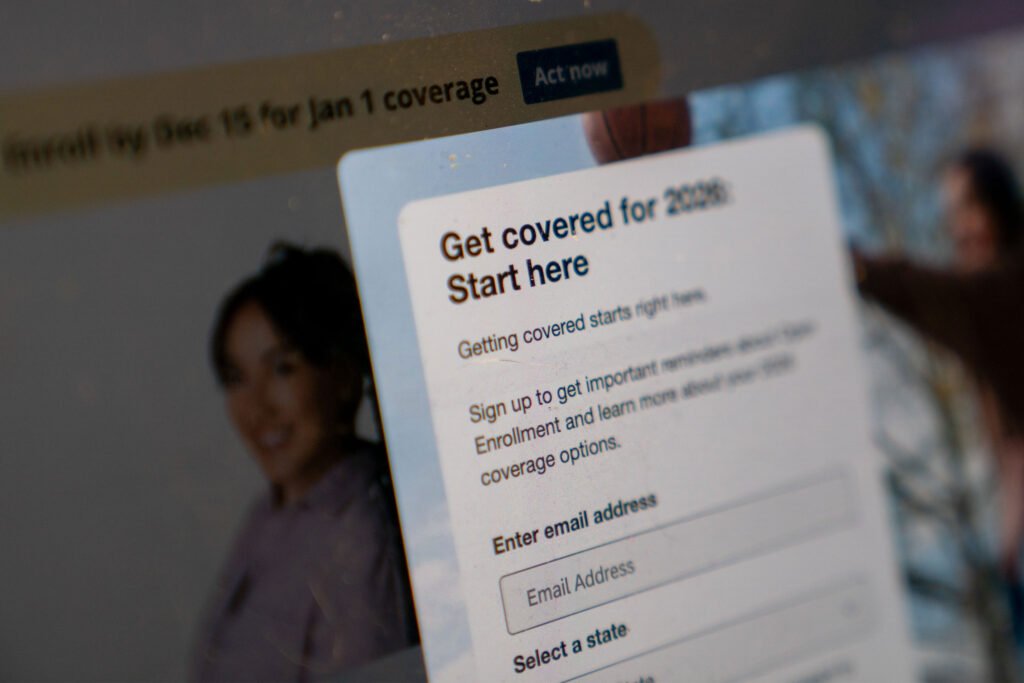

The current Obamacare open enrollment period is causing a lot of uncertainty and confusion for the 24 million individuals who purchase health insurance through the federal and state Affordable Care Act marketplaces. The fate of the enhanced premium tax credits, which make coverage more affordable for 92% of enrollees, is still undecided, leading to the possibility of significantly higher premiums.

To navigate through this challenging time, there are several steps that marketplace shoppers can take to make informed decisions for the upcoming plan year.

- Understand How We Got Here:

In 2021, as part of a covid-era relief package, the ACA premium tax credits were enhanced to lower costs for eligible individuals and expand eligibility to those with higher incomes. However, these enhancements are set to expire at the end of 2025 unless Congress takes action. The ongoing debate in Congress has led to a political battle that has further complicated the situation for marketplace enrollees. - Follow the News:

It is essential to stay informed about any developments in Congress regarding the extension of enhanced subsidies. Pay attention to daily Capitol Hill updates as they may impact your enrollment decision. Marketplace notifications about premium payments may be delayed, so it is crucial to stay proactive in seeking out information. - Update Your Account Information:

Ensure that your marketplace account is up to date with accurate income, household size, and other relevant details. Provide an accurate estimate of your anticipated income for 2026, especially considering the potential changes in premium tax credit caps. - Shop Based on Sticker Prices:

Due to the projected increase in health insurance premiums, focus on the listed price when evaluating plans. Without the enhanced tax credits, premiums are expected to rise significantly, making it necessary to assess affordability based on the sticker price. Consider enrolling in a less generous plan with a lower premium but a higher deductible if needed. - Come Back, Check, and Recheck:

Do not be discouraged by high premium prices initially. Congress may still act to restore the enhanced premium tax credits, potentially changing the landscape of available options. Open enrollment lasts until Jan. 15 in most states, allowing for flexibility in decision-making. - Wait To Pay Your Premium:

Premium payments are typically due before the plan takes effect, but marketplaces and insurers may offer extensions. If a last-minute deal changes the tax credit amount, individuals who have already paid their premium should still be able to receive the higher credit. State officials and insurance companies may implement creative solutions to accommodate changes during the enrollment period.By following these steps and staying informed, marketplace shoppers can navigate the uncertainties of this year’s open enrollment period and make informed choices for their health coverage.