The modern American healthcare system is collapsing under the weight of bureaucratic inefficiencies, and at the heart of this failure lies Electronic Data Interchange (EDI) payments. Initially introduced as a means to standardize billing and payment processes between providers and insurers, EDI has instead created a labyrinth of red tape, billing complexities, and administrative waste that has driven up costs, burdened providers, and reduced access to care.

The Root and Branch Destruction of Healthcare via EDI

EDI payments were designed to streamline claims processing, but the reality has been the opposite. Rather than improving efficiency, the system has forced medical professionals to navigate an ever-growing thicket of claim rejections, pre-authorization requirements, and payment delays. Instead of focusing on patient care, doctors are drowning in paperwork and administrative costs, leading to burnout and declining service quality.

Here are some of the fundamental ways in which EDI has dismantled the healthcare system:

1. Exorbitant Administrative Costs

A significant percentage of healthcare spending in the U.S. is wasted on billing and insurance-related expenses. Hospitals and private practices are forced to hire large administrative teams to process insurance claims, verify coverage, and dispute denied payments. These costs ultimately inflate the price of healthcare for everyone.

2. Delayed and Denied Payments

Under EDI, insurance companies wield excessive power over payments. Providers often wait weeks or months for reimbursement, only to have claims denied for minor technicalities. This creates cash flow problems for independent doctors and smaller clinics, driving many out of business and consolidating care under large hospital networks.

3. Patient Confusion and Limited Access

For patients, EDI has led to unpredictable pricing, surprise medical bills, and limited choice in care providers. The opaque nature of medical billing means patients often do not know the true cost of a service until after it has been performed, leaving them vulnerable to financial hardship.

4. Erosion of Doctor-Patient Relationships

With doctors spending more time on insurance paperwork than patient care, the doctor-patient relationship has suffered immensely. Physicians are forced to make medical decisions based on what insurance will cover, rather than what is best for the patient.

The Dangers of EDI and Data Hacks

EDI not only burdens the healthcare industry with inefficiencies but also exposes it to significant cybersecurity threats. The centralized and interconnected nature of EDI systems makes them prime targets for hackers. Data breaches and service interruptions due to vulnerabilities in EDI infrastructure have already caused massive disruptions in the industry.

1. The Change Healthcare Ransomware Attack (2023)

One of the most devastating EDI-related data breaches occurred in 2023 when Change Healthcare, a major payment and revenue cycle management company, was hit with a ransomware attack. The attack caused widespread service disruptions, preventing providers from processing insurance claims and payments for weeks. Many small healthcare practices struggled to stay operational due to the cash flow disruption, highlighting the fragility of an over-reliance on EDI.

2. The Anthem Data Breach (2015)

In 2015, Anthem, one of the largest health insurance companies in the U.S., suffered a massive data breach that exposed the personal and medical information of nearly 80 million individuals. Hackers exploited weaknesses in EDI data transfers to access sensitive records, including Social Security numbers, birthdates, and insurance details. This breach underscored the vulnerability of EDI-based data exchanges and the severe consequences of centralized medical billing systems.

3. The Optum Cyberattack (2024)

Another alarming incident occurred in early 2024 when Optum, a subsidiary of UnitedHealth Group, faced a major cyberattack that crippled EDI-dependent claims processing. As a result, payments were delayed across thousands of healthcare providers, forcing many to turn away patients or demand cash upfront. The incident once again demonstrated the risks of centralized EDI infrastructure and how a single point of failure can bring down the entire system.

These breaches highlight the dangers of relying on EDI for payment processing and patient data management. Unlike cash-pay models, which operate independently of these vulnerable systems, EDI exposes providers and patients to unnecessary risk.

The Solution: Cash Pay Healthcare

The antidote to the EDI disaster is a return to direct, cash-pay healthcare. By eliminating the middleman—insurance companies and their convoluted EDI systems—both providers and patients can benefit from a simplified, cost-effective, and transparent system.

1. Streamlined Payments and Reduced Costs

With cash pay, administrative burdens shrink dramatically. Physicians can set fair, transparent prices for their services, and patients can pay directly at the time of service. This eliminates the need for massive billing departments and drastically reduces overhead costs.

2. Immediate and Predictable Revenue for Providers

Doctors no longer have to wait months to be paid or deal with arbitrary claim denials. Cash payments mean immediate compensation, allowing practices to remain financially stable and independent.

3. Lower Costs for Patients

When providers aren’t inflating prices to account for insurance negotiations, the cost of medical services decreases. Many cash-pay clinics and direct primary care (DPC) practices offer significantly lower rates than those relying on insurance-based reimbursement.

4. Greater Access to Care

With transparent pricing and no insurance barriers, more patients can access the care they need without fear of financial ruin. Patients can budget for their healthcare needs and seek treatment without the uncertainty of whether insurance will cover a particular procedure.

5. Frictionless Experience for Members

Patients benefit from a seamless, hassle-free experience with no delays, claim denials, or unexpected bills. They can receive care without navigating the frustrating complexities of insurance approvals, ensuring a smoother, faster, and more personalized healthcare journey.

The Hybrid Model: EDI as a Last Resort

While the goal is to move away from EDI entirely, innovative platforms like yuzu.health (a Third-Party Administrator, or TPA) and WOOP (Waived Out of Pockets) – a Health Plan designer and Program Manager, have recognized the challenges of transitioning overnight. These companies have teamed up to make a world with minimal EDI closer to reality by using EDI only as a last resort in health plans.

By leveraging technology to prioritize cash payments and direct contracting, these platforms ensure that providers and patients experience the benefits of simplified transactions while still maintaining a safety net for those rare cases where traditional insurance billing is necessary. This hybrid approach allows for a gradual transition away from EDI while keeping essential coverage intact.

How Yuzu.health and WOOP Are Changing the Game

– Yuzu.health is the TPA that builds the technology infrastructure to support efficient direct payment systems, ensuring a smooth experience for both providers and patients. They also support EDI infrastructure, but updated the legacy technology to enable cash pay or EDI, depending on the plan design.

– WOOP (Waived Out of Pockets) acts as the program manager that handles direct contracting, care coordination, and cash-pay arrangements with providers. Additionally, WOOP helps lower prescription costs, making medications more affordable for patients.

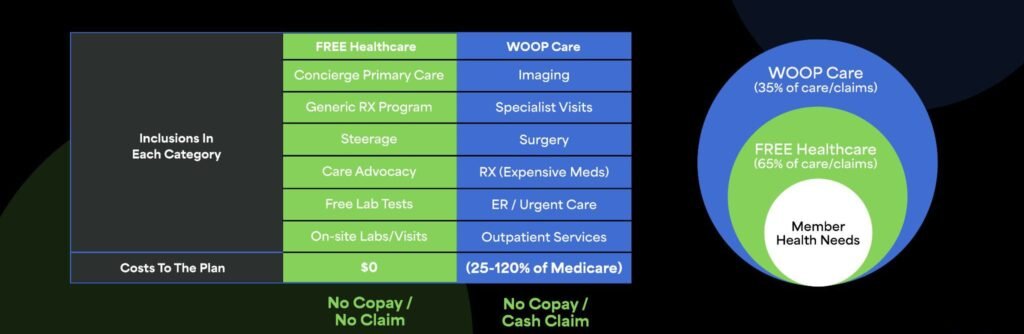

– WOOP plan designs enable a Netflix type layer within the health plan, where members can basically get as much primary care, urgent care, preventative care, generic medications, lab tests, steerage, care advocacy and onsite visits (for employer sites with more than 20 employees) as needed, with no claim and no copay for the member. Then, when the member needs something outside the Netflix layer, the members DPC provider coordinates with an in-house care-coordination team to find the relevant care, schedule the appointment on behalf of the member and provide the member with a virtual debit card (the funds come from the plan sponsors claims fund) to pay for the care at the point of care. According to Chief Commercial Officer Chris Barakat, the scope of these payments is quite vast “we use the virtual debit cards to pay for appointments, imaging, surgery, even high cost prescriptions that we can alternatively source. Only in situations outside of our control, do we lean on EDI for example, unexpected Emergency or long term hospitalization.”

– Together, these platforms ensure that cash payments take precedence, with EDI used only when absolutely necessary, making the transition smoother for both patients and providers.

“This approach reduces administrative burden on all parties and allows us to waive the members Out-of-pocket responsibility for members, because the savings we generate have been proven to be so large, we want to give the members an incentive for using the Non-EDI pathway” Barakat added.

Stop-Loss Companies Embracing the Low-EDI Model

Stop-loss insurers are recognizing the benefits of a low-EDI world, as their risk exposure decreases when plans pay the lowest possible cost for care. Instead of dealing with the inflated claims and administrative bloat that come with traditional insurance models, stop-loss carriers operating in a cash-pay environment face fewer unpredictable liabilities. By aligning with direct contracting and cash-pay arrangements, these insurers can lower overall premiums, pass savings on to employers, and reduce the volatility of healthcare expenditures. The shift benefits all parties involved, as it encourages true cost transparency and accountability in the healthcare system.

Independent TPAs: Wolves in Sheep’s Clothing

Many independent Third-Party Administrators (TPAs) claim to be anti-BUCA (Blue Cross, United, Cigna, Aetna), yet they remain heavily reliant on BUCA network contracts. These TPAs tout their independence while still operating within the traditional network-driven reimbursement system, afraid to challenge the status quo for fear of losing their lucrative network agreements. In reality, they provide little added value beyond what a conventional BUCA insurer offers. Their reluctance to adopt non-EDI payments stems from a fear of upsetting the existing power structure, leaving employers and providers with the same inefficiencies and bloated costs that plague traditional insurance arrangements.

The RBP Shell Game: Profiting Off Inflated Billed Charges

Reference-Based Pricing (RBP) platforms claim to reduce healthcare costs by negotiating discounts on billed charges. However, this entire model is built upon an artificial anchor point—billed charges that are grossly inflated to begin with. Hospitals and providers set exorbitant sticker prices, knowing that RBP platforms will negotiate “discounts” that still result in substantial overpayments. These platforms profit from the illusion of cost savings while perpetuating a system where healthcare prices remain untethered to actual costs. Because RBP depends on EDI infrastructure to function, it remains an extension of the very inefficiencies that it claims to solve, reinforcing the distorted pricing mechanisms that plague the industry.

A Future Without EDI

The transition to cash payments is underway, as numerous direct primary care (DPC) providers, specialty clinics, hospitals, ambulatory surgery centers, and imaging facilities are embracing this approach. The partnership between yuzu.health and WOOP is leading the way in shifting away from relying heavily on EDI systems, making it easier for employers to incorporate this model into the health plans they provide for their employees. The lack of EDI dependence is putting the relationship back into medicine, while also making the financing of medicine substantially more affordable.