The Future of GLP-1 Drugs: Overcoming Roadblocks for Patients and Pharma

The GLP-1 arena has become a battleground between pharmaceutical heavyweights Novo Nordisk and Eli Lilly as they vie for market dominance. With newcomers in the obesity drug space looking to make their mark, the competition is fierce. However, challenges are not just limited to market dynamics, as patients are facing roadblocks in their treatment journey.

Sam Faycurry, CEO of Fay, a network of nutritionists working with GLP-1 users, highlights the struggles faced by patients. “GLP-1s represent amazing progress in science, but they are not without their flaws. Many patients experience challenging side effects and reach plateaus in their treatment journey, leading them to question the value of continuing with the medication.”

Discontinuation Rates Soar

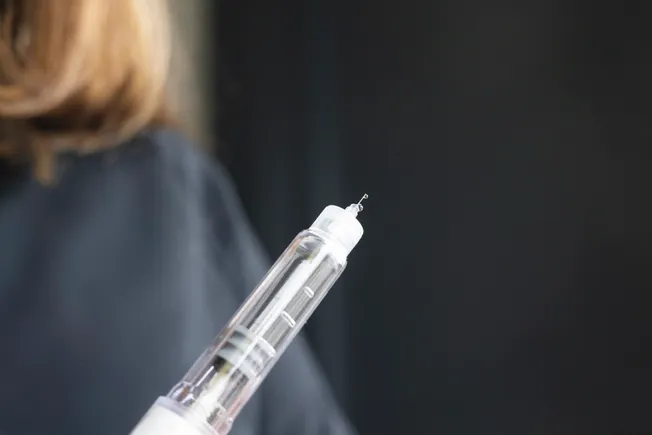

One of the primary obstacles for patients on GLP-1 drugs is the high rate of discontinuation. Studies have shown that between 50% and 75% of patients discontinue the medication within a year of starting treatment. At Fay, between 60% to 80% of patients encounter roadblocks such as side effects, plateaus, and insurance coverage declines.

Side effects such as vomiting, diarrhea, and nausea are common among GLP-1 users, with some also experiencing hair loss, muscle wasting, and mood changes. Even pharma companies developing next-generation drugs are facing similar challenges, with high discontinuation rates impacting clinical trial outcomes and real-world weight loss success.

Insurance Complications

Aside from side effects, insurance coverage poses a significant hurdle for patients on GLP-1 drugs. With a monthly cost of around $1,000 for pen injectables from Lilly and Novo, insurers have been hesitant to provide widespread coverage due to the expense. Only about 20% of employer-sponsored health plans covered GLP-1s for obesity as of last year.

Compounded versions of the drugs or out-of-pocket payments for vial doses have become common alternatives for patients facing insurance coverage issues. Pharmacy benefit managers are also factoring in the price tags when making coverage decisions, as seen with CVS Caremark dropping Lilly’s Zepbound in favor of Novo’s Wegovy due to cost considerations.

Despite the challenges, efforts are being made to address the roadblocks faced by patients on GLP-1 drugs. Real-world data on the impact of discontinuation rates on long-term weight outcomes are being studied, and insurers are exploring ways to provide coverage for these effective medications while balancing cost considerations.

As the GLP-1 landscape continues to evolve, overcoming these roadblocks will be crucial for ensuring that patients can access and benefit from these innovative treatments.

In the realm of healthcare, companies like Fay play a crucial role in connecting with patients and payers at various touchpoints. These touchpoints are essential for ensuring that the drugs prescribed are used properly and not abused. Faycurry, a representative from the company, highlighted that insurance providers are increasingly emphasizing the importance of consulting with a dietitian to support the proper use of medications, such as GLP-1s, used for weight management. This requirement for prior authorization mirrors the approach taken with procedures like bariatric surgery.

As insurers tighten their coverage policies, companies like Fay are poised to benefit. For instance, Cigna offers a comprehensive weight management program that includes nutrition support to complement GLP-1 coverage. This trend underscores a shift towards prioritizing lifestyle changes as a prerequisite before resorting to pharmaceutical interventions. Faycurry emphasized that while scientific advancements are being made, employers and payers are increasingly advocating for lifestyle modifications as a first-line approach.

The landscape of insurance coverage for weight loss medications like GLP-1s remains uncertain as their popularity continues to grow. Drug manufacturers are actively working to expand the range of weight loss options available to patients. Amid this evolving landscape, Faycurry acknowledged that the future remains uncertain, with ongoing discussions and debates shaping the direction of coverage policies.

In conclusion, the intersection of healthcare providers, patients, and payers is a dynamic space where companies like Fay play a pivotal role in navigating the evolving landscape of weight management treatments. By staying attuned to the changing needs of insurers and patients, these companies can effectively support the delivery of holistic care that prioritizes lifestyle modifications alongside pharmacological interventions. As the industry continues to evolve, collaboration and innovation will be key in driving positive outcomes for individuals seeking effective weight management solutions.