In a recent development, a federal judge in Texas has made a decision to overturn a finalized rule by the Consumer Financial Protection Bureau (CFPB) that aimed to eliminate medical debt from credit reports. U.S. District Court Judge Sean Jordan, appointed by Trump, ruled that the CFPB had overstepped its authority with this rule, stating that the Fair Credit Reporting Act does not allow for the removal of medical debt from credit reports.

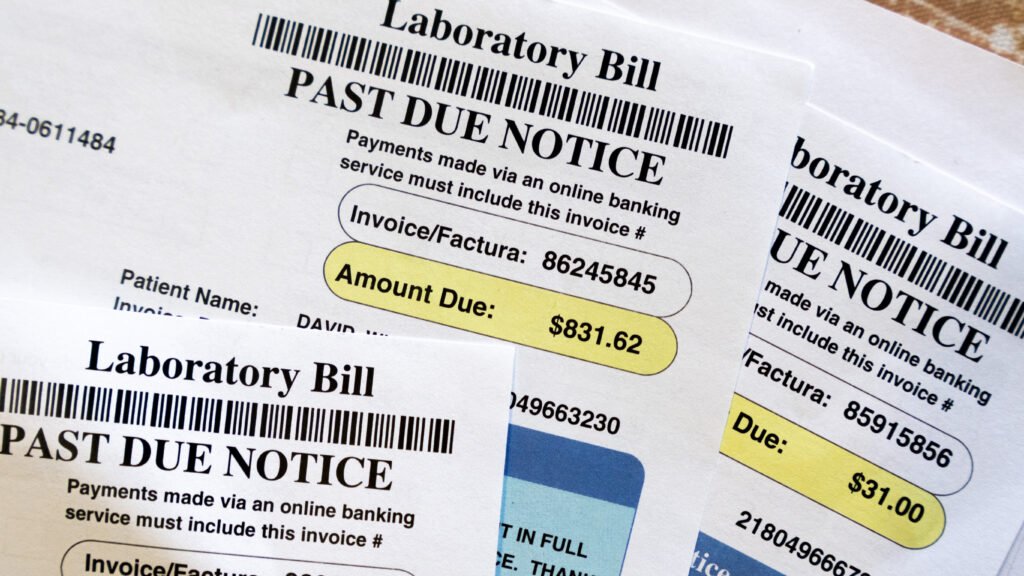

The rule, which was set to remove medical debts from consumer credit reports, was expected to raise the credit scores of millions of families by an average of 20 points. The CFPB argued that outstanding healthcare claims are not indicative of an individual’s ability to repay a loan and are often unfairly used to deny mortgage applications.

Last year, the three major credit reporting agencies – Experian, Equifax, and TransUnion – announced plans to remove medical collections under $500 from credit reports. The CFPB’s rule would have gone further by banning all outstanding medical bills from credit reports and preventing lenders from using this information.

The CFPB estimated that the rule would have eliminated $49 million in medical debt from the credit reports of 15 million Americans. It is worth noting that one in five Americans has at least one medical debt collection account on their credit report, and more than half of all collection entries on credit reports are related to medical debts. This issue disproportionately affects people of color, with 28% of Black individuals and 22% of Latino individuals carrying medical debt compared to 17% of white individuals.

The CFPB, established after the 2008 financial crisis, was tasked with overseeing credit card companies, mortgage providers, debt collectors, and other sectors of the consumer finance industry. However, earlier this year, the Trump administration requested that the agency cease almost all operations, effectively shutting it down.

This ruling by Judge Sean Jordan highlights the ongoing debate surrounding the inclusion of medical debt in credit reports and its impact on individuals’ financial well-being. The decision to reverse the CFPB’s rule underscores the complexities of balancing consumer protection with industry regulations in the financial sector.

As this issue continues to unfold, it is crucial for policymakers, regulators, and industry stakeholders to collaborate on solutions that promote financial inclusion and address the challenges faced by individuals burdened by medical debt. It remains to be seen how this ruling will shape the future of credit reporting and consumer financial protection in the United States.