Health Insurance Premiums Continue to Soar in California

By Phillip Reese

Kirk Vartan, a resident of California, is facing the harsh reality of skyrocketing health insurance premiums. Paying over $2,000 a month for a high-deductible plan from Blue Shield on Covered California, Vartan is feeling the financial strain despite not being sick. The reason he chose this expensive plan was to ensure that his wife’s doctor was included in the network, highlighting the sacrifices many Californians are making to maintain healthcare coverage.

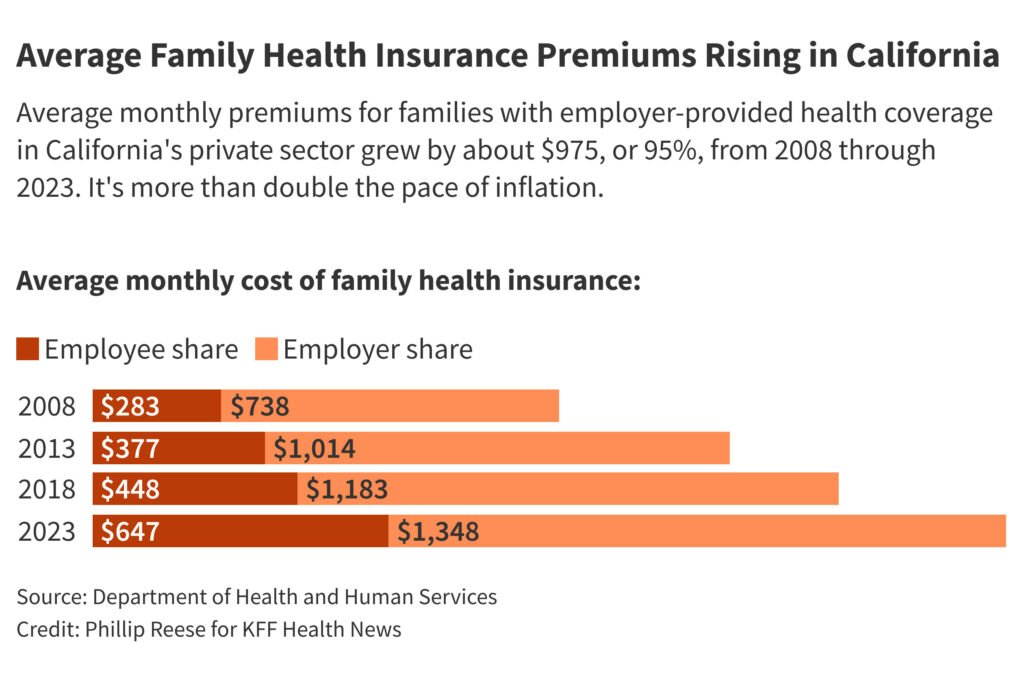

The trend of rising premiums is not unique to Vartan. Over the last 15 years, average monthly premiums for families with employer-provided health coverage in California have nearly doubled, reaching almost $2,000 in 2023. This sharp increase, more than twice the rate of inflation, has left employees shouldering a growing share of the cost.

Small-business groups are sounding the alarm, warning that without extended federal subsidies, the situation could worsen for workers without employer-provided coverage. Covered California, the state’s public marketplace, has seen premiums rise by about 25% since 2022, outpacing inflation. However, the exchange provides subsidies based on income to nearly 90% of enrollees, offering much-needed relief to many families.

Government workers are also feeling the pinch, with premiums at CalPERS, which covers over 1.5 million public employees and their families, rising by about 31% since 2022. These increases are straining public employers and workers alike, highlighting the broader impact of escalating healthcare costs.

Miranda Dietz, a researcher at the University of California-Berkeley Labor Center, points to rising hospital prices as a primary driver of premium growth. Consumer costs for healthcare services have outpaced overall inflation, putting pressure on insurers to raise premiums. Despite insurers’ profitability, their margins have remained stable, indicating that rising healthcare costs, rather than excessive profits, are behind the premium hikes.

For small businesses like Vartan’s pizza shop, the situation is particularly challenging. With limited negotiating power, these businesses struggle to provide affordable coverage to their employees. As a result, many workers turn to Covered California, further underscoring the strain on the healthcare system.

To address the escalating costs, California has implemented statewide spending growth caps through the Office of Health Care Affordability. These measures aim to curb premium increases and slow the rise of healthcare costs. While these efforts may help mitigate the problem, the underlying issue of affordability remains a significant concern for many Californians.

As healthcare costs continue to rise, individuals and businesses alike are grappling with the financial burden of maintaining coverage. The challenge now lies in finding sustainable solutions to ensure that healthcare remains accessible and affordable for all Californians.